Welcome, future home buyers! Today, we will delve into the world of Rocket Mortgage Home Loan reviews, providing you with a comprehensive look at mental care during the home-buying process. We understand how overwhelming and stressful purchasing a home can be, which is why we are here to guide you through the process and explore how Rocket Mortgage can help ease your mind. Let’s uncover how this innovative tool can provide mental support and reassurance during this exciting yet nerve-wracking time.

Rocket Mortgage: Overview

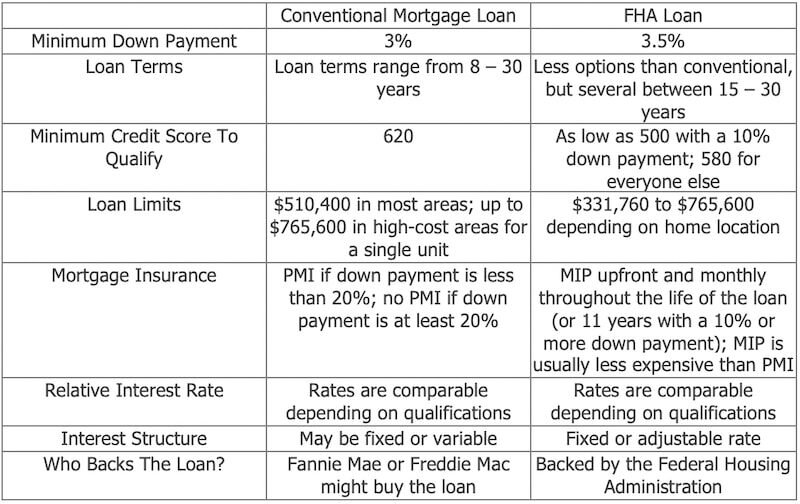

Rocket Mortgage is a popular online mortgage lender that allows borrowers to apply for and manage their home loans entirely online. Established in 2015, Rocket Mortgage has quickly gained a reputation for its efficiency, convenience, and user-friendly interface. It is a subsidiary of Quicken Loans, one of the largest mortgage lenders in the United States. Rocket Mortgage offers a variety of loan products, including conventional loans, FHA loans, VA loans, and jumbo loans.

One of the key features that sets Rocket Mortgage apart from traditional lenders is its fully digital application process. Borrowers can complete the entire loan application, from pre-approval to closing, online without ever having to step foot inside a bank branch. This streamlined process can save borrowers time and eliminate much of the hassle associated with traditional mortgage applications.

Additionally, Rocket Mortgage offers a range of tools and resources to help borrowers make more informed decisions about their home loan options. These tools include a mortgage calculator, which can estimate monthly payments based on loan amount, interest rate, and other factors. There is also a tool that allows borrowers to customize their loan options to find the best fit for their financial situation.

Customer service is another area where Rocket Mortgage excels. The company’s website features a live chat function, allowing borrowers to get answers to their questions from a real person in real time. Additionally, Rocket Mortgage assigns each borrower a dedicated loan officer who will guide them through the entire loan process and provide personalized advice and assistance.

Overall, Rocket Mortgage offers a modern and convenient approach to home lending that has resonated with many borrowers. Its innovative technology, user-friendly interface, and commitment to customer service make it a top choice for those looking to secure a home loan. Whether you’re a first-time homebuyer or a seasoned homeowner looking to refinance, Rocket Mortgage could be the right lender for you.

Pros and Cons of Rocket Mortgage Home Loans

Rocket Mortgage, the online mortgage platform offered by Quicken Loans, has gained popularity for its convenient and streamlined application process. However, like any financial product, Rocket Mortgage home loans come with both advantages and disadvantages. Let’s take a closer look at the pros and cons:

Pros:

1. Online Application Process: One of the biggest advantages of Rocket Mortgage is the online application process. Borrowers can apply for a mortgage from the comfort of their own home, without having to visit a physical branch. This convenience can save time and streamline the application process.

2. Fast Approval Time: Rocket Mortgage is known for its quick approval process. In many cases, borrowers can receive approval within minutes of submitting their application. This can be particularly beneficial for those who need to secure financing quickly.

3. Competitive Rates: Rocket Mortgage offers competitive rates on its home loans. By shopping around and comparing rates from multiple lenders, borrowers can find a loan that fits their budget and financial goals.

4. Personalized Loan Options: Rocket Mortgage offers a variety of loan options to meet the needs of different borrowers. Whether you’re a first-time homebuyer or looking to refinance your existing mortgage, Rocket Mortgage can help you find a loan that suits your needs.

5. Excellent Customer Service: Rocket Mortgage is known for its excellent customer service. Borrowers can reach out to the support team via phone, email, or online chat for assistance with their loan application or any questions they may have.

Cons:

1. Limited In-Person Support: While the online application process is convenient, some borrowers may prefer to have in-person support during the mortgage application process. Rocket Mortgage does not have physical branches, which can be a drawback for those who prefer face-to-face interaction.

2. Not Ideal for Complex Situations: Rocket Mortgage may not be the best option for borrowers with complex financial situations. If you have unique circumstances, such as self-employment income or a low credit score, you may find it challenging to secure a loan through Rocket Mortgage.

3. Potential Fees: Like any mortgage lender, Rocket Mortgage may charge fees for services such as application processing, underwriting, and closing. Borrowers should be aware of these fees and factor them into their overall cost when considering a loan from Rocket Mortgage.

Overall, Rocket Mortgage offers a convenient and efficient way to secure a home loan. By weighing the pros and cons, borrowers can determine if Rocket Mortgage is the right choice for their financial needs.

Originally posted 2025-02-08 11:00:00.