Hey there! Are you feeling overwhelmed by your student loan payments? It might be time to consider refinancing with Elfi. By refinancing, you could potentially lower your monthly payments and save money in the long run. Let’s take a closer look at how Elfi can help you take control of your student loan debt.

Eligibility criteria for Elfi student loan refinancing

Are you a recent graduate drowning in student loan debt? Are you struggling to make monthly payments to multiple lenders? If so, refinancing your student loans with Elfi could be the solution you’ve been looking for. Elfi student loan refinance offers competitive rates and flexible terms to help borrowers save money and simplify their repayment process.

So, what are the eligibility criteria for Elfi student loan refinancing? First and foremost, applicants must have a minimum credit score of 680 to qualify for refinancing. This requirement ensures that borrowers have a good credit history and are likely to make on-time payments. Additionally, applicants must have a minimum annual income of $35,000 to demonstrate their ability to repay the refinanced loan.

Another important eligibility criterion for Elfi student loan refinancing is the amount of outstanding student loan debt. In order to qualify for refinancing, borrowers must have at least $15,000 in student loan debt. This requirement ensures that borrowers have a substantial amount of debt to refinance and can benefit from the lower interest rates and flexible terms offered by Elfi.

Furthermore, borrowers must be U.S. citizens or permanent residents to qualify for Elfi student loan refinancing. This requirement ensures that borrowers are legally eligible to enter into a refinancing agreement and can benefit from the services offered by Elfi. International students and non-U.S. residents are not eligible for refinancing through Elfi.

One final eligibility criterion for Elfi student loan refinancing is the type of degree obtained by the borrower. In order to qualify for refinancing, borrowers must have a minimum of a bachelor’s degree from an accredited institution. This requirement ensures that borrowers have completed a higher education program and have the potential to earn a higher income in the future.

In conclusion, Elfi student loan refinancing offers competitive rates and flexible terms to help borrowers save money and simplify their repayment process. In order to qualify for refinancing, applicants must meet certain eligibility criteria, including a minimum credit score, annual income, outstanding debt amount, citizenship status, and type of degree obtained. If you meet these criteria, refinancing your student loans with Elfi could be the key to improving your financial situation and achieving your long-term goals.

Benefits of refinancing your student loans with Elfi

Refinancing your student loans with Elfi can provide a multitude of benefits that can help make managing your loans easier and potentially save you money in the long run. Here are some of the key advantages of refinancing your student loans with Elfi:

1. Lower interest rates: By refinancing your student loans with Elfi, you may be able to secure a lower interest rate than what you are currently paying on your loans. This can result in significant savings over the life of your loan as you will be paying less in interest each month.

2. Consolidation of loans: Refinancing your student loans with Elfi allows you to consolidate multiple loans into one single loan, simplifying the repayment process. Instead of making multiple payments to different lenders each month, you will only have to worry about one payment to Elfi. This can help streamline your finances and make it easier to keep track of your payments.

3. Flexible repayment options: Elfi offers a variety of repayment options, including fixed and variable interest rates, as well as different loan terms. This flexibility allows you to choose a repayment plan that best fits your financial situation and goals. Whether you prefer a shorter loan term with higher monthly payments or a longer term with lower payments, Elfi has options to accommodate your needs.

4. Potential for lower monthly payments: By securing a lower interest rate and choosing a longer loan term, you may be able to lower your monthly payments when refinancing with Elfi. This can free up additional cash flow each month, allowing you to allocate funds towards other financial goals or expenses.

5. Personalized customer service: Elfi prides itself on providing exceptional customer service to its borrowers. Whether you have questions about the refinancing process, need help choosing a repayment plan, or want to discuss your options, Elfi’s team of loan specialists is available to assist you every step of the way. You can feel confident knowing that you have a dedicated team supporting you throughout the refinancing process.

Overall, refinancing your student loans with Elfi can offer a range of benefits that can help you save money, simplify your finances, and customize your repayment plan to fit your needs. With lower interest rates, consolidation of loans, flexible repayment options, and personalized customer service, Elfi is a great choice for borrowers looking to take control of their student loan debt.

How to apply for student loan refinancing through Elfi

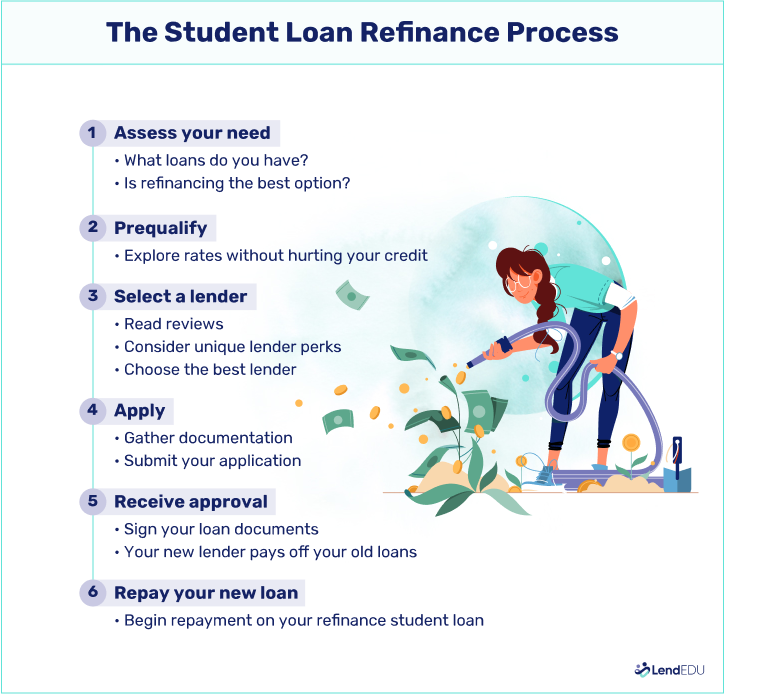

Applying for student loan refinancing through Elfi is a simple and straightforward process that can help you lower your interest rates and save money on your monthly payments. Here are the steps you need to follow to apply for student loan refinancing through Elfi:

1. Check your eligibility: Before you apply for student loan refinancing through Elfi, you should make sure that you meet the eligibility criteria. Generally, you must be a U.S. citizen or permanent resident, have a minimum credit score of 680, and have a minimum annual income of $35,000. You must also have at least $15,000 in student loan debt to qualify for refinancing through Elfi.

2. Gather your documents: Once you have confirmed that you meet the eligibility criteria, you will need to gather the necessary documents to apply for student loan refinancing through Elfi. These documents typically include your most recent pay stubs, tax returns, and student loan statements. Having these documents ready ahead of time can help speed up the application process.

3. Apply online: The next step is to visit the Elfi website and fill out the online application form. You will need to provide information about your current student loans, income, employment status, and more. You will also have the opportunity to select your desired loan terms, including the length of the loan and the type of interest rate (fixed or variable).

4. Review your loan offers: After you submit your application, Elfi will review your information and present you with loan offers that are tailored to your financial situation. You will have the opportunity to compare the interest rates, terms, and monthly payments of each offer before making a decision.

5. Choose your loan and sign the paperwork: Once you have selected the loan offer that best fits your needs, you will need to sign the loan agreement and any other required paperwork. Elfi will then work with your current loan servicer to pay off your existing student loans and transfer the balance to your new loan with Elfi.

6. Start making payments: With your new loan in place, you can begin making monthly payments to Elfi according to the terms of your loan agreement. By refinancing your student loans through Elfi, you can potentially lower your interest rates, reduce your monthly payments, and save money over the life of your loan.

Understanding interest rates and repayment terms with Elfi

When it comes to refinancing your student loans with Elfi, it’s important to understand how interest rates and repayment terms work. Interest rates are essentially the additional amount you have to pay on top of the principal loan amount. This is how lenders make money off of the loans they provide. The interest rate you receive from Elfi will depend on a variety of factors, including your credit score, income, and the type of degree you have. The better your financial situation, the lower your interest rate is likely to be.

Repayment terms refer to the length of time you have to pay back your student loan refinanced with Elfi. Typically, repayment terms can vary from 5 to 20 years depending on your agreement with the lender. When choosing a repayment term, it’s important to consider your financial situation and how quickly you want to pay off your loan. A shorter repayment term will mean higher monthly payments but less interest paid overall, while a longer repayment term will result in lower monthly payments but more interest paid over the life of the loan.

With Elfi, you have the option to choose between fixed or variable interest rates for your student loan refinancing. A fixed interest rate means that your interest rate will remain the same throughout the life of your loan, providing you with predictable monthly payments. On the other hand, a variable interest rate means that your interest rate can fluctuate over time based on market conditions. While variable interest rates may start lower than fixed rates, they can increase over time, potentially causing your monthly payments to increase as well.

It’s important to carefully consider the pros and cons of fixed versus variable interest rates when refinancing your student loans with Elfi. If you value predictability and want to know exactly how much you’ll be paying each month, a fixed interest rate may be the best option for you. However, if you’re comfortable with the possibility of your interest rate changing and potentially lowering your payments initially, a variable interest rate could be the way to go.

Tips for successfully managing your Elfi student loan refinance account

Managing your Elfi student loan refinance account can be a breeze with the right tips and strategies in place. Here are some helpful pointers to ensure you make the most of your refinanced loan:

1. Stay organized: Keeping track of your loan details, payment schedules, and any important documents related to your refinanced loan is essential for successful management. Consider setting up a dedicated folder or digital file to store all your loan information in one place.

2. Set up autopay: Avoid missing payments and late fees by setting up autopay for your Elfi student loan refinance account. This convenient option allows your monthly payments to be automatically deducted from your bank account, ensuring timely payments every month.

3. Monitor your interest rate: Keep an eye on your interest rate to ensure you are getting the best deal possible. If interest rates drop or your financial situation improves, you may want to consider refinancing again to secure a lower rate and save money in the long run.

4. Communicate with your lender: If you experience any financial hardships or need assistance with your loan payments, don’t hesitate to reach out to your lender. Many lenders offer flexible repayment options or hardship programs to help borrowers in difficult situations.

5. Create a budget: A budget is a crucial tool for successfully managing your Elfi student loan refinance account. By tracking your income and expenses, you can prioritize your loan payments and ensure you stay on track to pay off your loan. Consider creating a spreadsheet or using budgeting apps to help you manage your finances effectively.

Originally posted 2025-08-29 08:00:00.